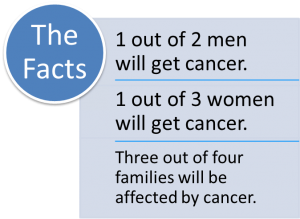

Two of the biggest reasons for disability: Cancer and Accident.

Most people have no idea, unless they have experienced cancer, what it does to a family.

- Home foreclosure/eviction notice

- Utility disconnection notices

- Insurance lapse notices

- Car reposession

“Cancer is the fastest-growing cause for disability claims… Why? In part, this reflects a rising rate of cancer. It could also result from more effective treatment… We’re doing medical miracles today, people are living much longer after a cancer diagnosis than they once did.”

WebMD Article, Leading Causes of Disability (2011)

- If your child undergoes chemotherapy, will you be there — or at work?

- Where will you stay while your child under goes treatment if the best hospital is not in your city?

- What will you do if experimental treatment is the only option to save your child’s life?

- If your spouse is the sole salary earner what do you do when they can’t provide for the family because of cancer?

Income Protection is the Answer.

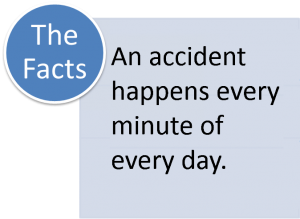

Helps with high deductible plans. Pays benefits per-accident, with no yearly deductible.

This is a great plan for children in organized sports or activities. Your child DOES NOT HAVE TO BE IN A SCHOOL SPONSORED ACTIVITY AS WITH TYPICAL SCHOOL ACCIDENT PLANS.

Not a replacement for Workers Compensation.

- Pays up to $4000 in hospital and medical expenses per accident

- Pays up to $10,000 for CARE FLIGHT and ground ambulance

- Pays up to $10,000 in accidental death benefit

- Pays up to $20,000 in dismemberment benefits

- Premiums are around a $1 per day, depending on plan choice

- Not limited on number of accidents

- 28 Days to seek treatment vs. 3 days with other policies

- Protects your income by covering expenses under your major medical deductible

Income Protection is the Answer.